Option Calculator

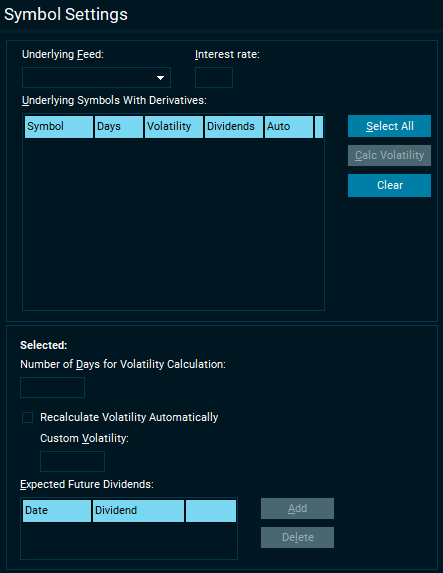

Symbol Settings

Element | Description |

|---|---|

Underlying feed | The settings will apply to all underlying symbols for the options feed you select. |

Interest rate | Many calculations require an interest rate in order to calculate the values. Specify an interest rate here you wish to use. |

Selected | Once you have selected some underlying symbols, you can set custom volatility periods, and have them recalculate automatically. Alternatively, set a custom value for volatility. |

Volatility

Volatility measures how much the underlying instrument is expected to change over time. This value is needed by the option calculations and must be set manually in this dialog.

Element | Definition |

|---|---|

Define Feed and symbols | Select the feed and the underlying instrument. The list of feeds will only include the active underlying feeds of the currently loaded option feeds. |

Define Interest rate | Determines the basic risk-free rate for the market as a whole. This default value is 5%. |

Set Volatility | Select symbol(s) in the list and click the "Set Volatility" button to change the volatility value. This requires that you have determined a preferred volatility value for each underlying symbol. Calculating the historical volatilities may take some time. You may close the "Option Calculation Setup" dialog, and the volatilities will still be calculated and updated correctly as they are received from the server. You will get a notification about this, but this message can be suppressed in the future by checking the "Don't show this message again" checkbox. |

Dividends | If the company of the underlying instrument is planning to pay dividends in the future (but before the option expires), this will influence the option price. To ensure that the calculations are adjusted accordingly, enter the dividend date and amount here. Each underlying instrument may have any number of future dividends registered. Only dividends inside the expire period will be considered during the calculations. Use the "Add" button to add new dividends. Use the "Delete" button to remove a dividend. |

Calculation Methods | The option calculation engine supports three different option models. Each method is used for different kinds of options as indicated by the default values in the dialog. |

Black & Scholes | This is option-pricing model was first introduced by Fischer Black and Myron Scholes in 1973. It is used for European options (such as the OBX options on Oslo Options). European options cannot be exercised before the expire date. |

Binomial | John Cox, Stephen Ross and Mark Rubinstein introduced the Binomial Option-pricing Model in 1979. It is used for American options (such as the NHY options on Oslo Options). American options can be exercised any time up to and including the expire date. |

Black & Scholes-76 | This option-pricing model is a variation of the standard Black & Scholes model, and was presented by Fischer Black in 1976. This model is used when the underlying instrument is a futures contract. |

Limits | The option calculation engine will produce results of a specific accuracy. The minimum acceptable accuracy can be specified here. Also, the engine relies on iterating through a number of calculations, increasingly finding a more accurate answer. The maximum number of iterations can also be set here. |