ESG features, methodology and use cases

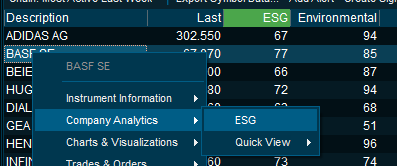

- A new ESG Platform to visualise and contextualise three levels of data on a company level, easily accessed from the right-click menu of a company (or you can double-click any ESG column):

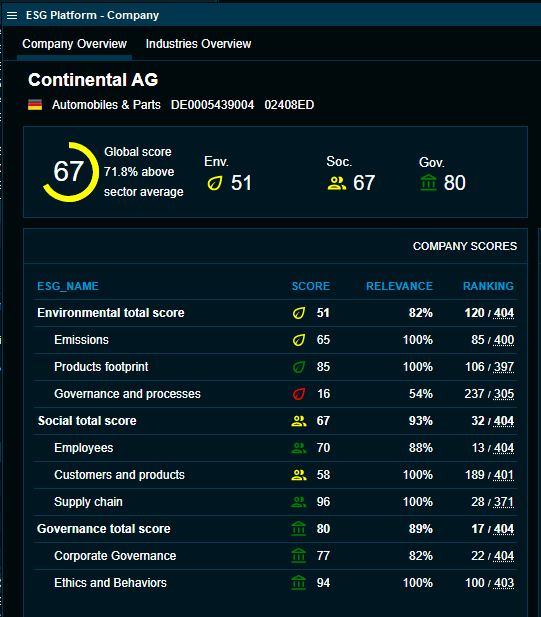

- Scores are colour-coded based on performance in addition to visual elements for their respective category within Environmental, Social or Governance:

The ESG dataset is based on scores ranging from 0-100 (with 100 as the best) and covers companies, funds and governments. The scores express the risk and opportunities the company holds against key exposure points within the respective specific sector.

ESG Risk scores aim to assess the financial materiality of environmental, social and governance issues related to how companies and governments operate. Hence, scores assess how ESG issues potentially affect future financial performance.

Companies in the same industry generally face the same major risks and opportunities, though individual exposure can vary.

ESG Risk scores allow investors to assess how well the companies and countries in a given portfolio are managing their Environmental, Social and Governance related risks and opportunities.

A risk is material to an industry when it is likely that companies in a given industry will incur substantial costs in connection with it (for example, a regulatory ban on a key chemical input requiring reformulation).

Furthermore, a new regulation coming into place can correspondingly shift the scores of an entire sector and in turn develop depending on how the companies individually address this regulation.

As such, the risk score can be interpreted as to what extent the company has mitigated risk or holds exposure towards ESG factors faced in the respective sector. Both the exposure and the potential impact on financial materiality is weighted into a risk score.

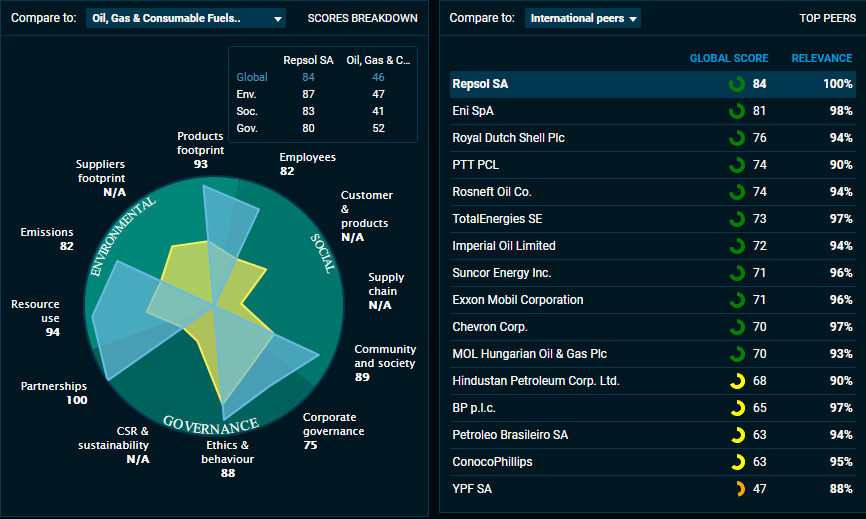

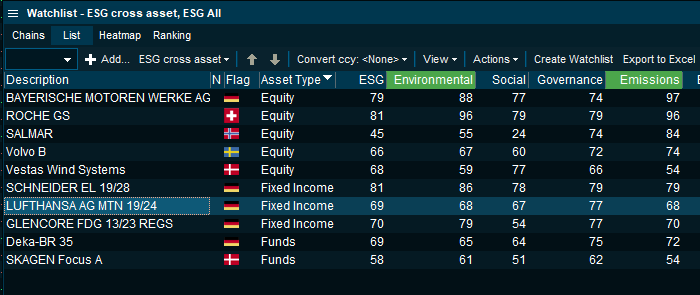

As an example, this is why Repsol as an oil and energy company can hold a higher environmental score at 87 than Vestas Wind at 59. This tells us that Repsol have mitigated their exposure to a larger extent or holds a more robust and diversified business model, better positioned for the opportunities within the oil and energy sector, which again may lead to strong future financial performance.

Detailed documentation on methodology and framework is available through our sales, support and client success team.

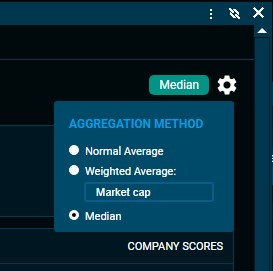

- The platform includes an "Industries" tab for deeper insight within a sector as well as configurable peer group analysis and graphics. The calculation method can be adjusted to your preference and the platform can also be linked to other windows:

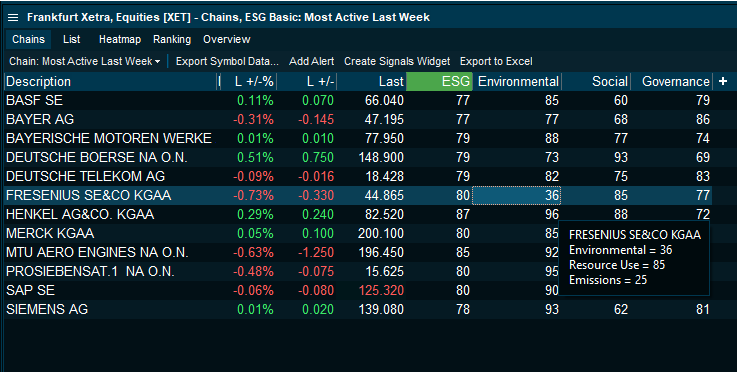

- A new column set is introduced to be applied in market overview and watchlists to bring forward this advanced dataset. Applying the terminal's column sorting and filtering, this enables you to easily screen and structure an entire market based on overall ESG score. Detailed parameters such as Supplier Footprint or Corporate Ethics may be applied as well as seen in the example with the Xetra exchange below:

- By applying the ESG Basic layout to the Xetra main market, you can filter out only the top ESG score candidates by sliding the bar in the column filter. For example, you will find that even though Fresenius falls within this range at the total score, Fresenius' "Environmental" score is quite poor at 36 further explained by the third level parameters shown in the hover, clearly weakened by the "Emissions" score at only 25.

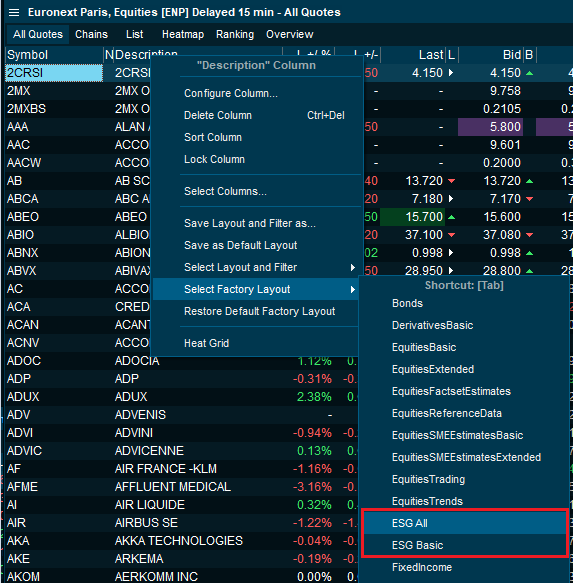

- In addition to a new column category found in the configurator, two new ESG layouts were added to the factory layouts and can easily be applied to any market overview or watchlist.

The "ESG Basic" layout includes 2 levels of granularity, and the "ESG Full" layout naturally includes all the parameters for a more detailed approach:

- The dataset covers equities, fixed income and funds, so by applying the layout in a watchlist you may combine these for a cross-asset overview.

- Individual scores are available in the "Details" tab of every "Instrument Overview" window and included in the "Peer group" overview on the "Company Overview" tab.

For questions or additional information, please refer to your respective Client Success Manager or reach out to our support.