Custom Instruments

The newly launched Custom Instruments (CI) feature enables you to tap into the entire Infront universe and create bespoke synthetic instruments fit for your individual needs.

CI allow you to combine different existing instruments across asset classes, exchanges and markets to adapt to your specific analysis.

This leverages the full power of the to discover new unexplored use cases. You can create any mathematical formula with familiar Excel syntax to create spreads, benchmarks, industry trackers, tailored indices and so on.

As an example, you may typically want to manipulate an existing index to control for a specific company constituent as it represents an outlier or skew the index, for the purpose of your individual analysis.

This can easily be created as a CI by starting with the existing index:

For example, take the Oslo Seafood Index tracking the third biggest industry in Norway and the number one capital market index worldwide for farming of seafood. The index consists of only 10 constituents causing individual factors of a company to skew the entire index. Thus, a new Norwegian tax decision can shift the entire market. However two of the constituents, companies in the business of salmon farming, Salmones Camanchaca and Bakkafrost, are incorporated in Chile and Faroe Island respectively and might be affected differently than the other index contributors with Norwegian incorporation. Now you can control for this as they may "camouflage" how the tax impacts companies differently depending on nationalities.

Starting with the original index, we can create a CI controlling for this:

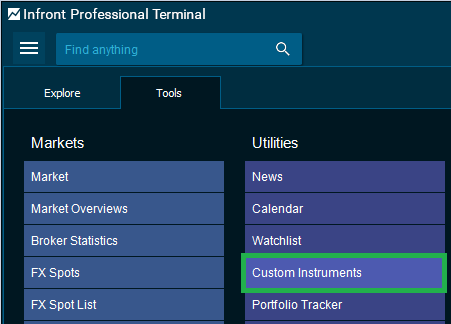

Open CI from the "Tools" menu:

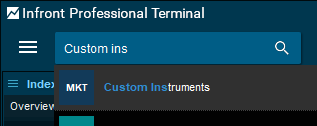

Alternatively, via search:

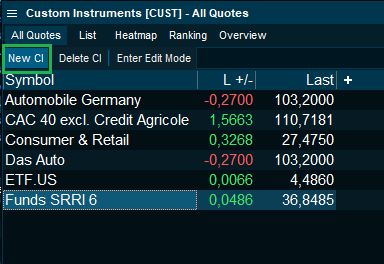

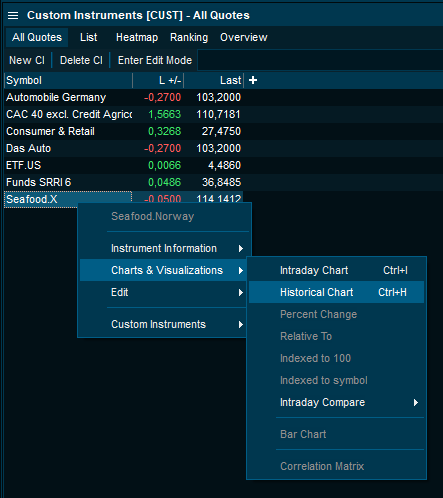

Custom Instruments (CI) opens as a Market or Watchlist where all your CIs are stored and can be managed and tracked collectively.

To open a new CI and create a bespoke seafood index:

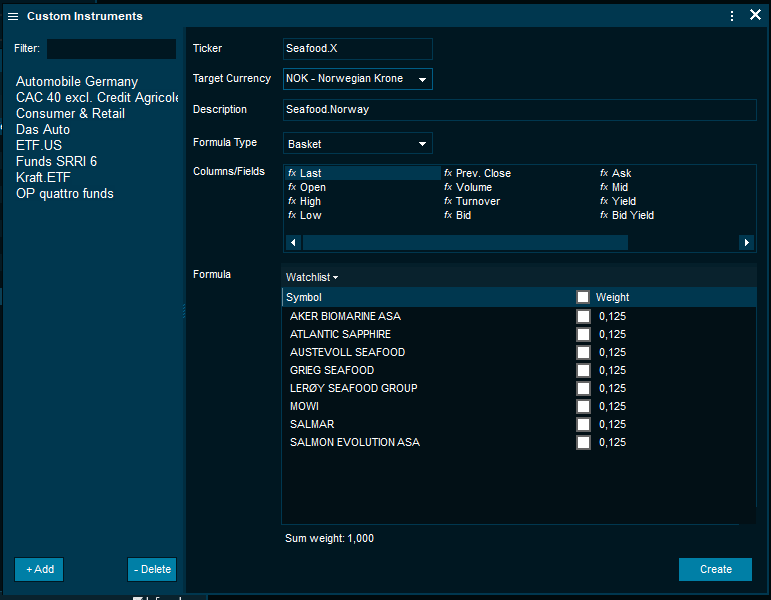

Once a name and currency is set, you can simply drag and drop your selection into the "Formula" field and weights will be assigned equally by default.

The "Basket" formula type manages weights and instruments easily, while the "Free text" mode offers a more detailed formula-specific Excel syntax depending on your preference.

Delete Bakkafrost and Salmones Camanchaca. Then, weights are automatically recalculated and distributed to the remaining 8 companies.

Click the "Create" button to save it and your new CI now exists in the market list with the complete and familiar functionality of any other instrument, for instance a historical chart:

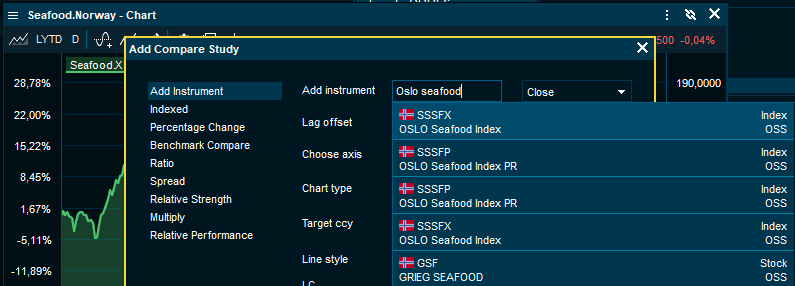

Next, we compare the new Custom Index with the original index via the familiar compare function:

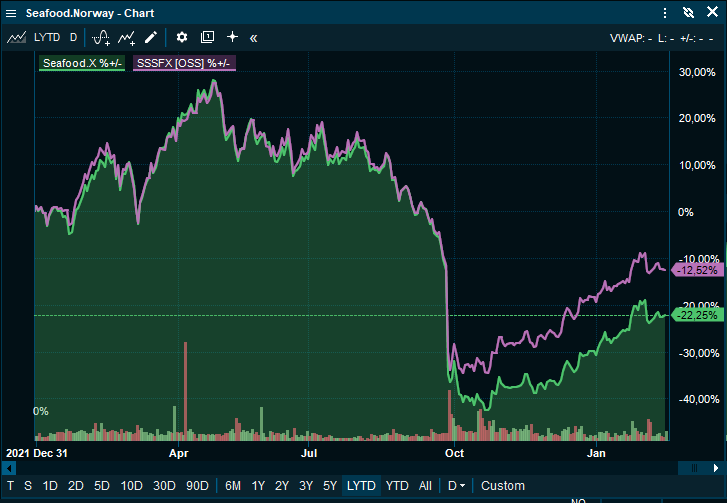

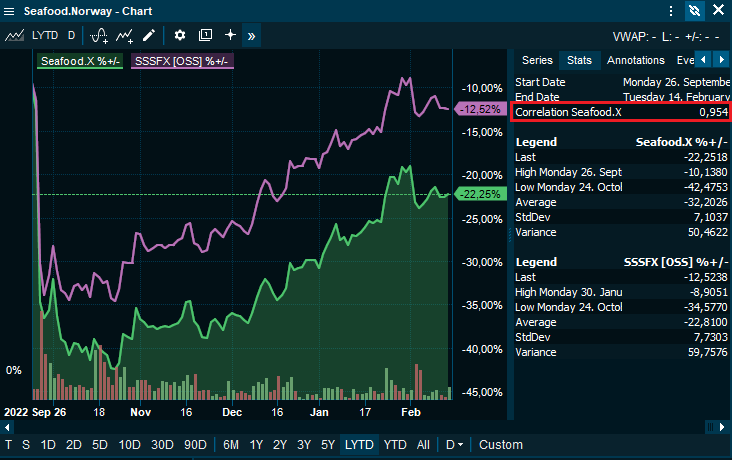

It reveals a tight and nearly perfect relationship between the two until October when the new tax regime was announced, and the market responded by plummeting more than 25%.

After this, the relationship is still perfectly correlated, but our new custom index remains shifted at a higher level suggesting that the taxation affects the companies differently depending on nationality and skews the index.

In that context, the correlation coefficient can now be observed directly in the chart statistics of the compared charts:

CI can also be used as benchmarks within Portfolio Tracker so you can create your own tailored benchmarks to gauge and capture specific effects that are possibleignored by the listed indices and traditional benchmarks.

Furthermore, CIs can be used within the Portfolio Tracker as a benchmark.

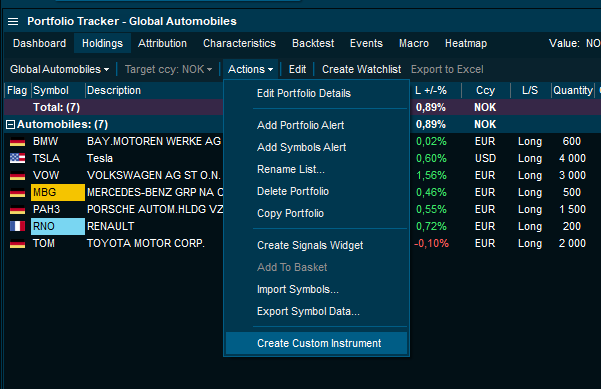

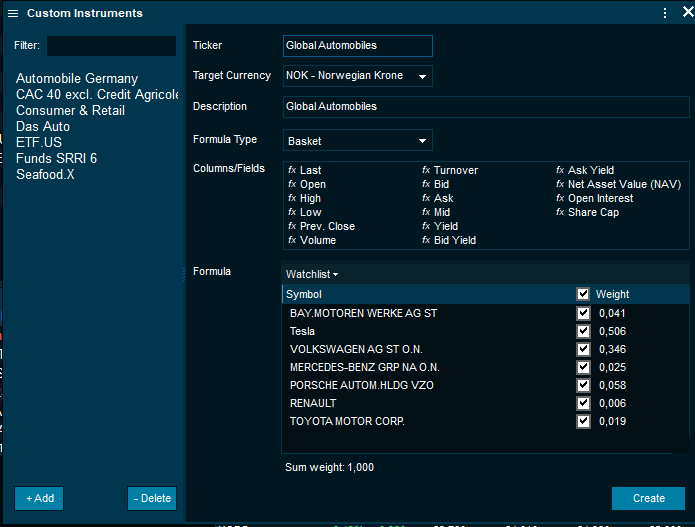

You can also create a CI directly from the Portfolio Tracker from your portfolio. This allows you to easily add your portfolio as a synthetic instrument to your watchlist or run any technical chart analysis, spread charts and so on.

Weights are calculated from the position volumes and automatically assigned in the CI:

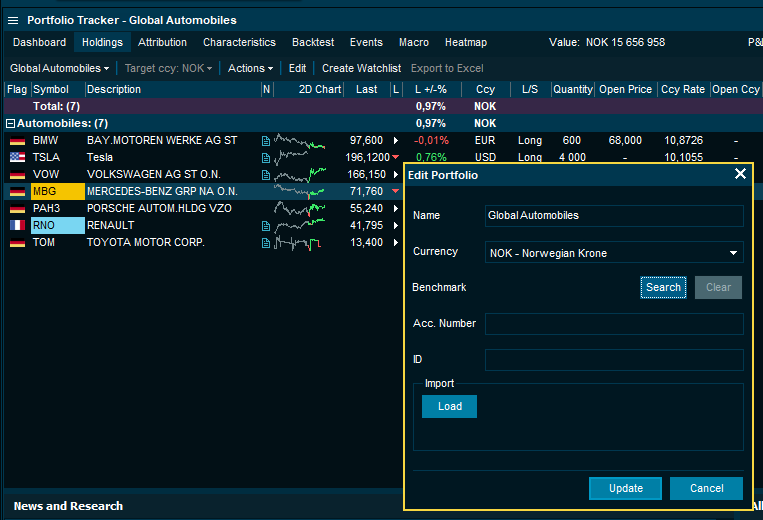

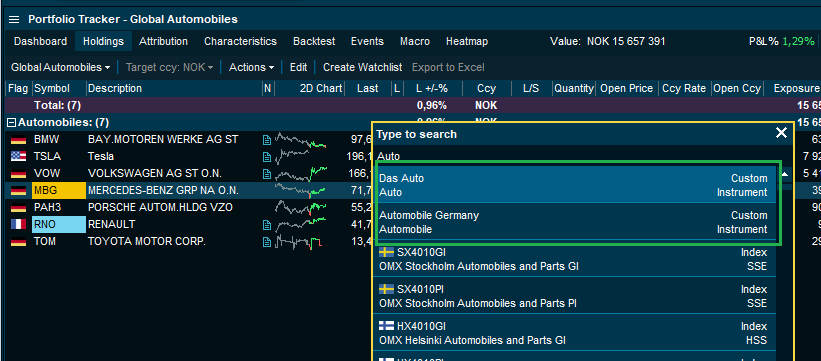

CIs can also be used as benchmarks within Portfolio Tracker so you can create you own tailored benchmarks.

Additional use cases for CI include:

- Performance & spread of investment company vs. underlying listed investments, detect and monitor situations of price mismatches and rebates

- Rights issue in an equity, create a custom instrument with the equity & right in order to monitor price discrepancies.

- ESG Risk score can be applied to construct your own sustainability indices or typically create tailored benchmarks adapting to different ESG methodologies, or with special emphasis on ethical awareness according to specific mandates.

With the new Custom Instruments, the opportunities are endless, enabling you to analyse and discover more with .