Credit ratings and WM data in the Infront Professional Terminal

As the next step in our integration plan and fixed income strategy, we introduced credit ratings and WM data in the latest version of .

Following the integration of contributor bond data, credit ratings provide an added layer of insight into the debt market and its inherent credit risk. Ratings data is provided by the market leading agencies S&P, Moody's and Fitch* and includes ratings on the individual bonds on the issue level as well as the issuer on the overall entity level.

Several new features were introduced to help you navigate and structure this data:

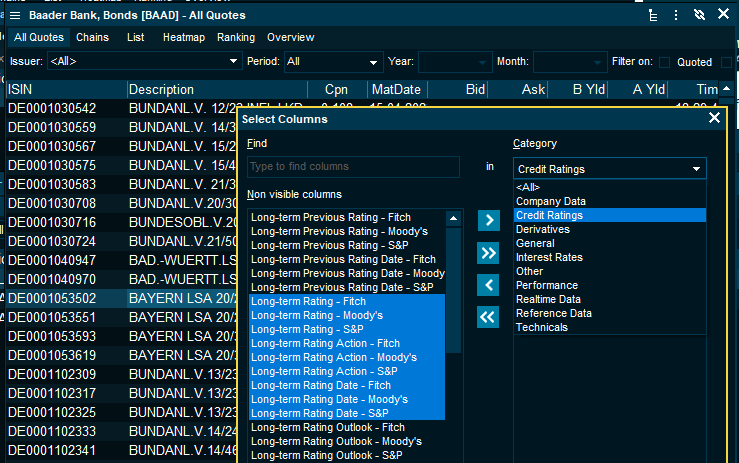

- First and foremost, a new set of columns which can easily be added to a "Market view" or your personal watchlist.

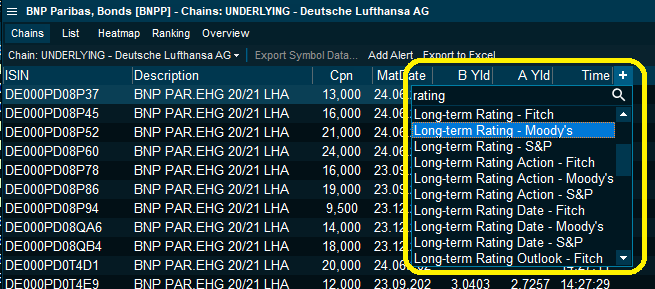

Columns can be added by using the "+" icon on the right of the columns. Or you can view the full selection in the "Select Columns" dialog window by the "Credit Ratings" category:

As the agencies apply different scales to their rating methodology, each agency holds their own dedicated set of columns and fields. This means that there is no consolidated rating view across sources.

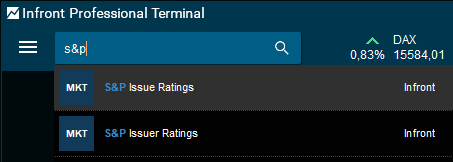

Consequently, individual agency feeds are also available in the "Market" view:

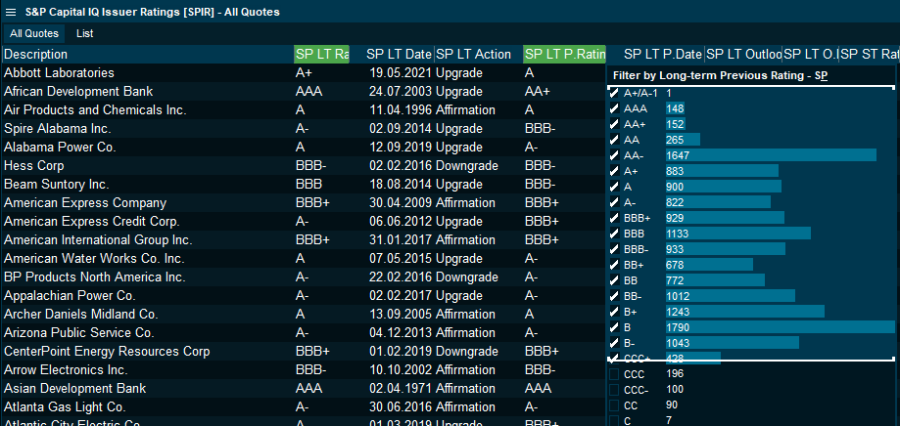

In the individual agency feeds, the respective columns are automatically populated as seen below with S&P:

- Every column offers filtering capabilities, allowing you to screen on a market or agency universe. Typical filtering scenarios include: only investment grade ratings, only the most recent assessments by date or only affirmations. For example, you can filter the Frankfurt Floor market based on Fitch rating, only "B" and above, by simply sliding the bar to the preferred level:

- In the "Market" and "Watchlist" view, this can be applied across the agencies to show multiple rating agencies' columns (that is, S&P and Moody's). Moreover, the column filtering tool displays the distribution in a certain market or from the agency universe.

- Feeds are available from each agency so you can typically filter out S&P's most recent upgrades by date, with a stable outlook and a current rating of A+ and above if you have a conservative mandate.

- You can also filter yield intervals to capture any relationship between high yields and respective rating which traditionally should not fall within investment grade.

- In the watchlist, you have full flexibility to further analyse different bonds across issuers and discover if certain properties of the loan affect the rating across the issuers' bonds.

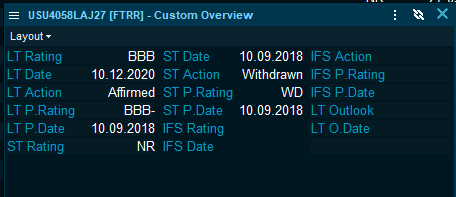

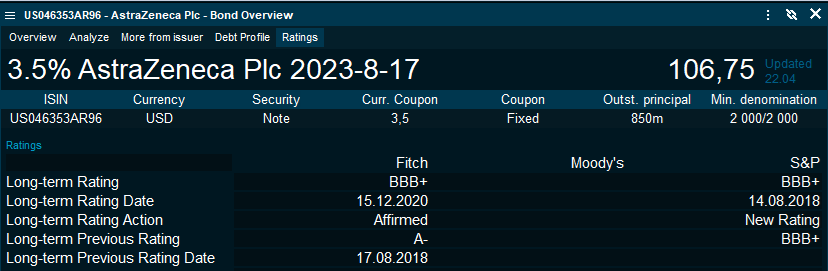

A new tab was added to the "Bond Overview", consolidating the information for the specific bond. Long-term ratings are displayed on the "Overview" tab:

The "Custom Overview" consolidates all ratings data for the instrument and substitutes the "Instrument Overview".