FX Forward Calculator

FX Forward Calculator

Infront FX Forward Calculator allows you to calculate forward points and rates for a currency pair and any value (settlement) date, display forward curves as well as points charts. The calculator adjusts for non-banking days and informs you about specific holidays and weekends. In addition, it allows you to set a pricing date in the past to extract the points and rates for the date chosen and display the adjusted forward curve. You can easily setup a broken date schedule with several date lines for a quick overview of the upcoming transaction prices.

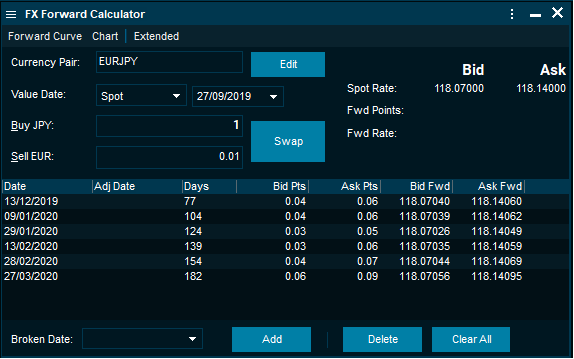

Single calculation panel

You can calculate forward points and rate for a single date by entering a currency pair and a value date. The value date is either a standard tenor (1M, 3M) or a broken date. If the chosen value date falls on a non-business day, it will be rolled-over to the following business day automatically.

Spot date, day count convention and number of days can be checked by holding the mouse above the single calculation panel.

You can also calculate the transaction amount based on the real time rates of the chosen currency pair. This is done by entering a Buy or Sell amount which then triggers the calculation of the opposite. User can define an amount by typing in codes K for thousand and M for million. Typing in 25M will fill in the Buy/Sell section with an amount of 25,000,000.

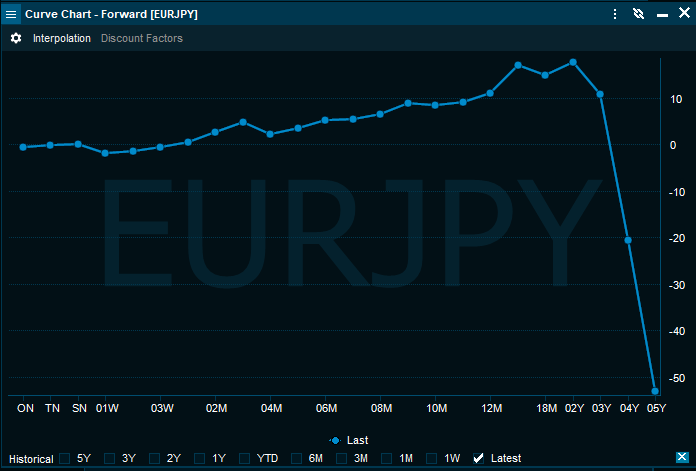

Forward Curve and Chart

You can display a forward curve, points and rates, for the chosen currency pair by clicking "Forward Curve". The curve is adjusted once the user changes the currency pair. You can also display a forward curve chart by clicking the chart. The chart is built by using the forward points of the chosen currency pair. When changing a currency pair, the chart is not adjusted automatically.

Broken dates schedule

FX Forwards Calculator calculates forward points and rates for any date by applying linear interpolation as follows:

Previous rate + ((Next Rate - Previous Rate)/DLP)*DPY

where

DLP = Number of days in the time interval between the two regular dates (first and second rate)

DPY = Number of days from the earlier regular date to the interpolated date

User can check which rates are used to interpolate each of the broken date rates by holding the mouse above the broken date line in question.

If any of the broken dates fall on a non-business day, it will be rolled-over to the following business day. These dates will be marked yellow. This feature can be disabled in the "Extended" menu of the FX Forwards Calculator.

User can define broken dates by using several user-friendly codes:

Code | Description |

|---|---|

DD | Sets day in the same month and year as Today. |

DDMM | Sets day and month in the same year as Today. |

DDMMYY, DDMMYYYY | Sets day, month and year. |

+X, +Xd | Adds X days to Today. |

+Xm | Adds X months to Today. |

+Xy | Adds X years to Today. |

Extended menu

Extended menu allows for advanced functionality:

- Price source changes

- Pricing date changes

- Day count changes

User can change both, spot and forward price sources.

User can change the pricing date to a past date. This will cause the calculations to be performed as-of-the chosen date. The rates used in calculations are the average rates for different tenors on the date defined as a pricing date. User is able to display a forward curve using those points and rates as well as perform broken date calculations.

User can disable the calculation on the adjusted dates. Calculations will then be performed on all dates disregarding holidays and other non-business days.