Corporate Debt module

Find out more about the Infront Professional Terminal Corporate Debt module.

Corporate Debt module has a special focus on pricing and fundamental data for listed and OTC debt in the Nordic and biggest European debt markets. The module is targeting buy and sell-side market participants looking for an effective, venue/contributor overview, possibility to calculate yield or price a bond on a given yield as well as calculate several important risk indicators. A powerful debt screening functionality allows the user to search by several important factors such as type, security, issuer industry and yield in addition to a free-text search which ensures the user will find what they are looking for every time.

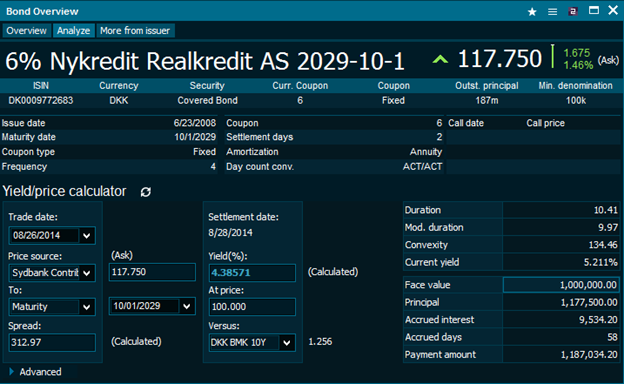

Unique "Bond Overview" pages consolidate data for the instrument and display it in a way that provides the user with critical information in a timely and effective way. Bond overview covers reference data, market and indicative prices and an overview of the other issues from the same issuer. From here, the user can navigate further to each and every venue the bond is traded on, issuer fundamentals or proceed with analytics. Yield calculator calculates yield from price and price from yield until Maturity, Next call, Worst as well as a Custom date. The calculated yield is compared to a benchmark for spread analysis. Last but not least, the user can calculate the payment amount for a transaction taking into account principal and accrued interest.

Yield/price calculator - methodology

An analytic tool allowing to calculate a yield on a bond from a given price or a price from a given yield. The calculator provides flexibility to modify several calculation input factors for sensitivity analysis.

Calculator is filled with the reference and market data needed to perform a calculation. The latest available price (either market or indicative) is used by default.

Infront yield/price calculator currently supports calculations on the following types of bonds:

- Fixed rate callable bonds

- Floating rate bullet bonds

- Floating rate callable bonds

- Zero coupon bonds

- Perpetual fixed bonds

User can change the following values manually by either typing a new value or choosing a value from a drop-down list:

| Element | Description |

|---|---|

| Trade date | Affect the settlement date. |

| Price source | Depends on user’s access rights. |

Price | |

Yield | |

| To date | The date to which calculation will be performed. |

| At price | The redemption price of the bond. |

| Spread | Spread between a chosen benchmark and current bond instrument. |

| Versus | Benchmark to which the current bond will be compared. |

Usability

Changing a price will trigger a yield and spread calculation.

Changing a yield will trigger a price calculation.

Modifying a spread will adjust the yield and trigger a price calculation.

Calculated values are marked in bold and are blue. Modified values are marked bold and are green.

Calculator performs calculations to the following "exit" dates:

Maturity – chosen by default

| Element | Description |

|---|---|

| Next call | For instruments with one or more call option dates. |

| Worst | Returns the worst yield and a date at which the yield is worst out of all possible exit dates. |

Custom | Calculation is performed for a date you specified. |

Currently, spreads are calculated against a pre-defined list of government benchmark bonds. Default benchmarks are chosen based on maturity and country of a bond instrument. User can choose any benchmark bond from the drop-down list.

Floating rate bonds

Infront yield/price calculator prices floating rate bonds using swap curves.

Methodology - Swap curves

Swap curves are bootstrapped using deposit rates for the short-term of the curve up to 1 year. For the long-term of the curve, from 1 to 30 years, the curve is built using swap rates. These rates reflect the fixed coupon rate of a fixed-floating swap where the fixed leg would be valued at 100. Linear interpolation method is used to smooth out the curves. Where direct swap rates are unavailable due to illiquidity, basis swap rates are using to derive the needed swap rates.

Infront currently prices bonds using the following reference rates:

NIBOR: 1M, 3M, 6M

STIBOR: 3M

CIBOR: 6M

EURIBOR: 1M, 3M, 6M, 12M

Other methodology:

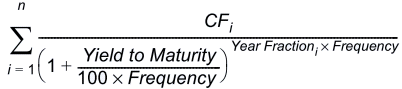

Price + Accrued interest =

Duration =

Where:

Frequency is the number of payments per year

P is the clean price plus accrued interest

N is the number of periods until maturity

Yield is yield to maturity

Li is the year fraction between the settlement date and the ith coupon

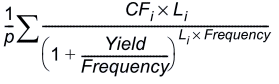

Modified duration =

Where:

D is duration

Yield is yield to maturity

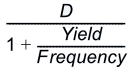

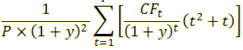

Convexity =

Where:

P is the current bond price

Y is yield to maturity

T is maturity in years

Current yield: annual interest payment / current price

Principal: Current price x Face Value

Accrued interest: CouponValue Date x Year fraction, where year fraction is calculated based on a day count convention for a bond

Payment amount: Principal + Accrued interest

Advanced

Advanced section of the calculator allows the user to modify several factors affecting the calculation. A new yield will be calculated immediately after a user changes an input. Each of the following input values can be changed by either typing in a new value or choosing a value from a drop-down menu:

- Calendar country

- Current coupon type

- Coupon frequency

- Day count convention

- Current coupon size

- Reference rate (for floating instruments only)

- Spread (for floating instruments only)